Challenge, transcendence, coll

Southeast Asian pet market is experiencing an explosive period

In recent years, the development speed of the global pet industry has been astonishing, especially in emerging markets such as Southeast Asia. People's attention to pets is continuously increasing, and their market growth rate is no less than, and even some regions have surpassed other mature markets.

In Southeast Asia, more and more pet owners are treating their pets as part of their families. They attach great importance to emotional support needs and are willing to spend more energy and money on providing the best care for their pets. This further promotes the expansion of the local pet market and increases the diversified demand for pet products from pet owners.

01

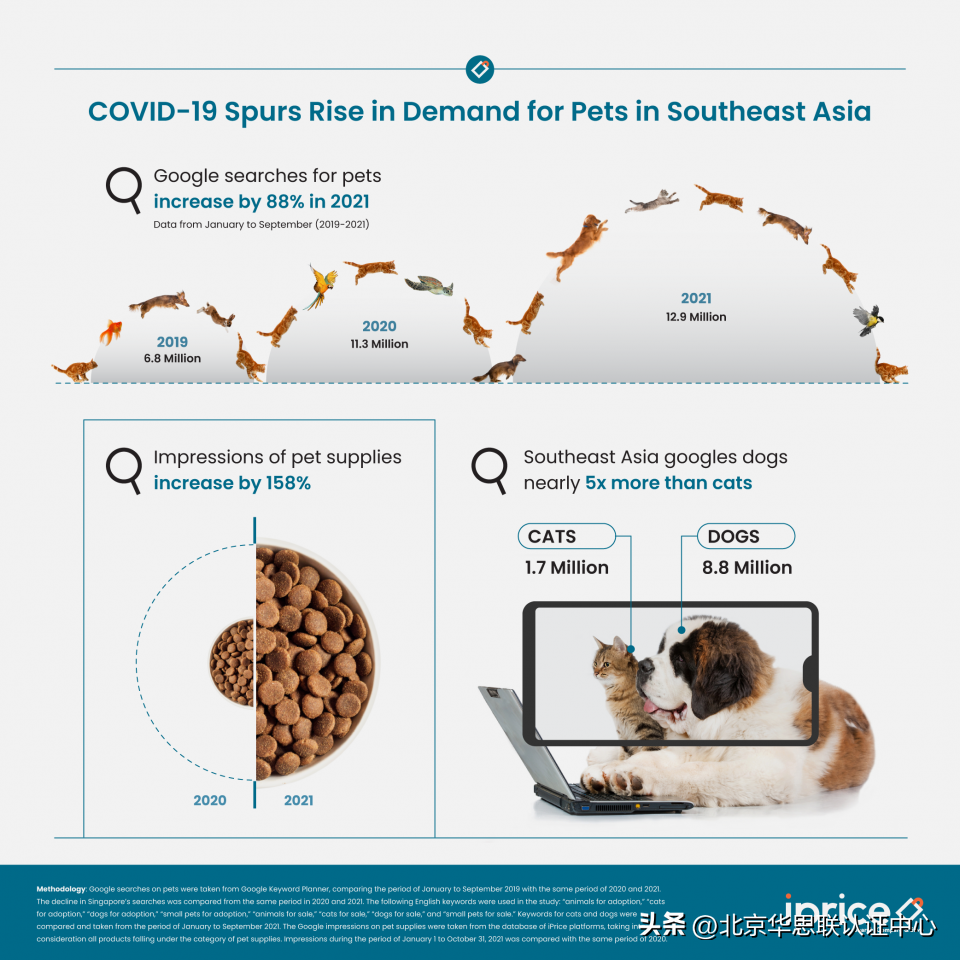

Pet search volume has increased by nearly 90%

According to multiple studies, keeping pets not only provides companionship for owners, but also effectively alleviates anxiety and stress. This may be why Southeast Asian people's interest in pets is constantly increasing. According to a survey by iPrice, Google's search volume for pets in Southeast Asia increased by 88% in 2021, reaching approximately 12.9 million times. The epidemic at home is one of the main reasons for stimulating this demand increase.

In addition, research data from leading e-commerce aggregators in Southeast Asia has found that there has been a significant increase in the number of times Southeast Asians search for pets on Google, and the advertising exposure of pet products on Google is also increasing.

From the perspective of growth rate:

Malaysia and the Philippines have seen the largest growth in pet search volume, reaching 118%; Indonesia and Thailand have a median search volume, with growth of 88% and 66% respectively; Vietnam followed closely, with a 34% increase in search volume; Singapore may experience a 7% decrease in pet searches compared to the previous year due to the easing of the epidemic.

From the perspective of search volume:

The Philippines has the highest overall search volume, with nearly 7 million searches between January and September 2021; Vietnam has over 1.8 million searches, ranking second.

From the perspective of advertising exposure:

From January to October 2021, the advertising exposure of pet products on the Google platform increased by 158% compared to the previous year. Among them, Thailand led with a growth rate of 350%; Next is Malaysia, accounting for 243%; Vietnam ranks third, with a growth rate of 220%.

02

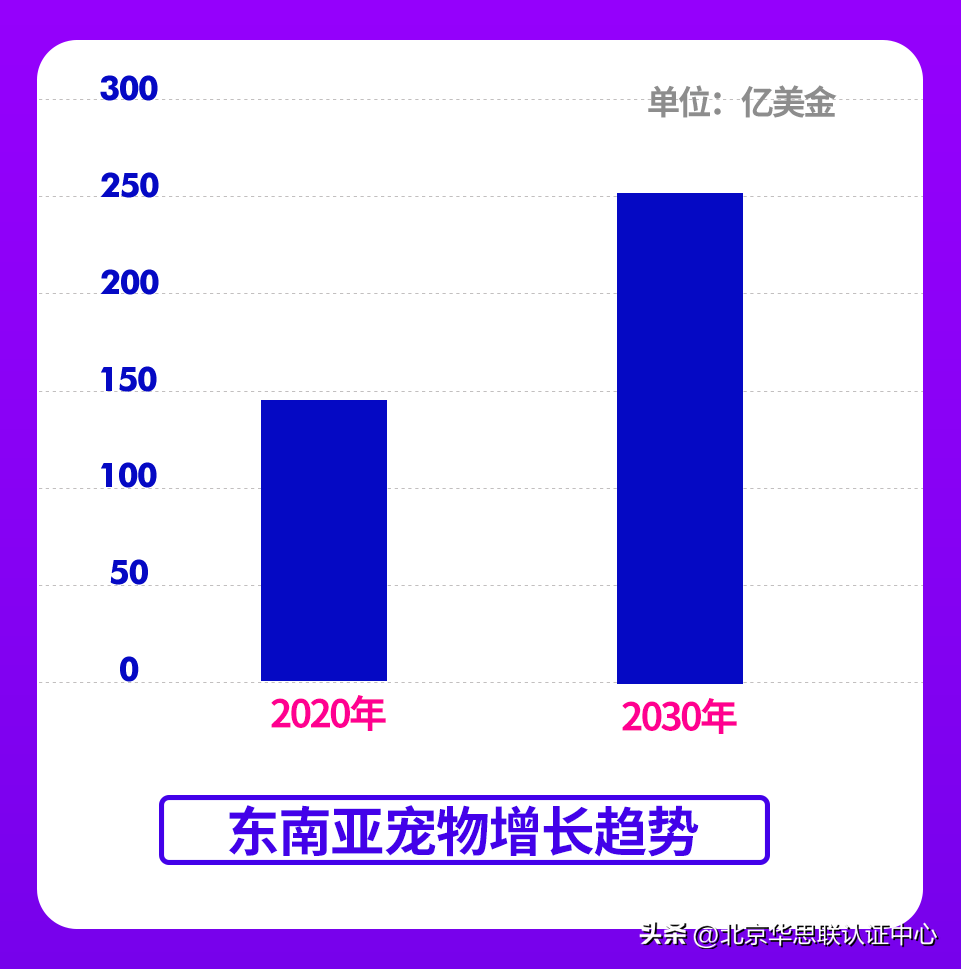

The pet market size may reach 25 billion US dollars

According to relevant research data, the global pet market is expected to reach 270 billion yuan by 2025. In Southeast Asia, pet products have also become one of the fastest-growing industries in the region. Lazada previously released a data forecast that the pet market size in Southeast Asia will grow from $15 billion in 2020 to $25 billion by 2030.

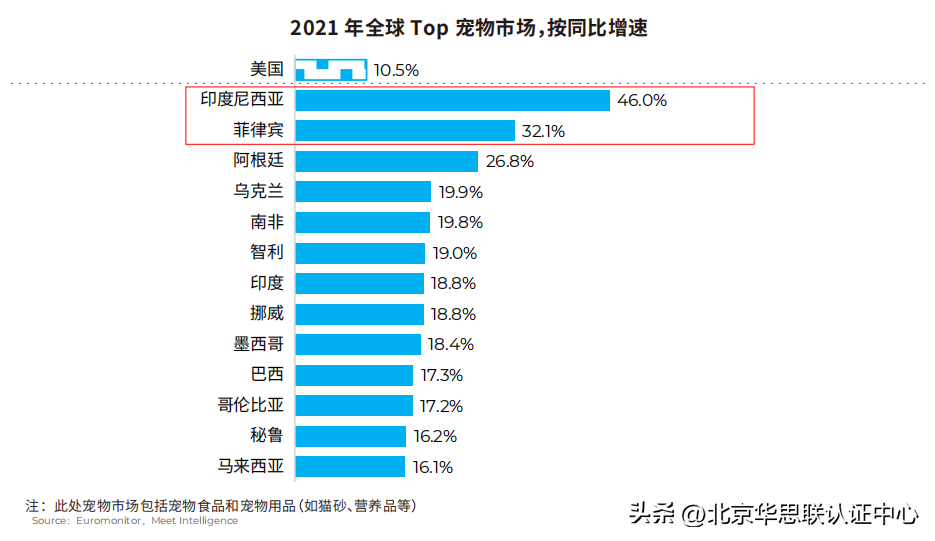

According to the "2022 Global Pet Market White Paper" released by Airwallex, Indonesia and the Philippines in Southeast Asia had the fastest year-on-year growth rates in 2021, reaching 46% and 32.1% respectively.

In terms of the overall market development, due to cultural and religious differences among Southeast Asian countries, pet preferences and consumption vary, and each market will also exhibit different development trends. Currently, in the markets of Thailand, Malaysia, Vietnam, and Indonesia, pet dog related consumption is relatively leading, while in the markets of Singapore and the Philippines, pet cat related consumption is more popular.

03

Southeast Asia has the highest ownership rate of cats and dogs

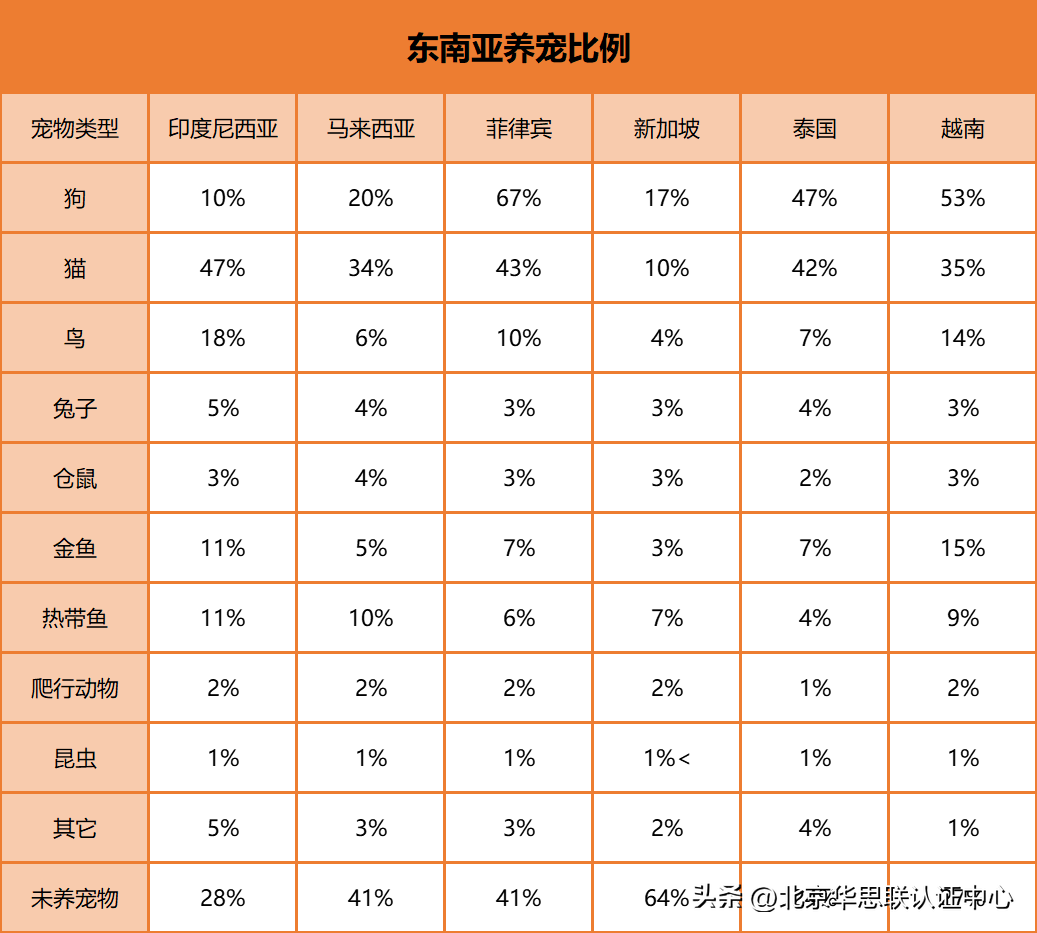

Over the past few decades, the ownership of pets in Southeast Asia has been increasing, and with the economic growth of the region, the treatment of pets has also changed according to the living standards of the population. According to Rakuten Insight's survey of nearly 100000 respondents, as of 2021:

The highest pet ownership rate: Indonesia, Vietnam, Philippines, and Thailand

Top three pet ownership ratios: dogs, cats, and goldfish

Cats and dogs have ownership rates of over 40%: Philippines and Thailand

The highest dog ownership rate: Philippines

The highest cat ownership rate: Indonesia

The lowest dog ownership rate: Indonesia, due to religious influence

The lowest cat ownership rate is in Singapore, where renting a house does not allow keeping cats (apartments and private homes can be kept). According to the policies of the Singapore Housing Authority or relaxing regulations, there will be new frameworks for regulation. According to a survey conducted by the Singapore Cat Welfare Association, about 91% of respondents do not oppose keeping cats in group houses, which may drive the growth of cat ownership rate

Favorite Petty Birds: Indonesia, Vietnam, and the Philippines

The lowest proportion of people without pets: only 24% of people in Thailand do not have pets

According to data from iPrice research, cats and dogs are the most popular in Southeast Asia. Among them, the search volume of dogs is more than five times that of cats.

It is worth mentioning that the younger generation is gradually becoming the main group of pet owners in Southeast Asia, with a pet ownership rate of about 50% among young people aged 26 to 35.

From this, we can see that the pet raising rate in Southeast Asia is over half, and young people will play a significant role in the consumption of pet products, with unlimited potential.

04

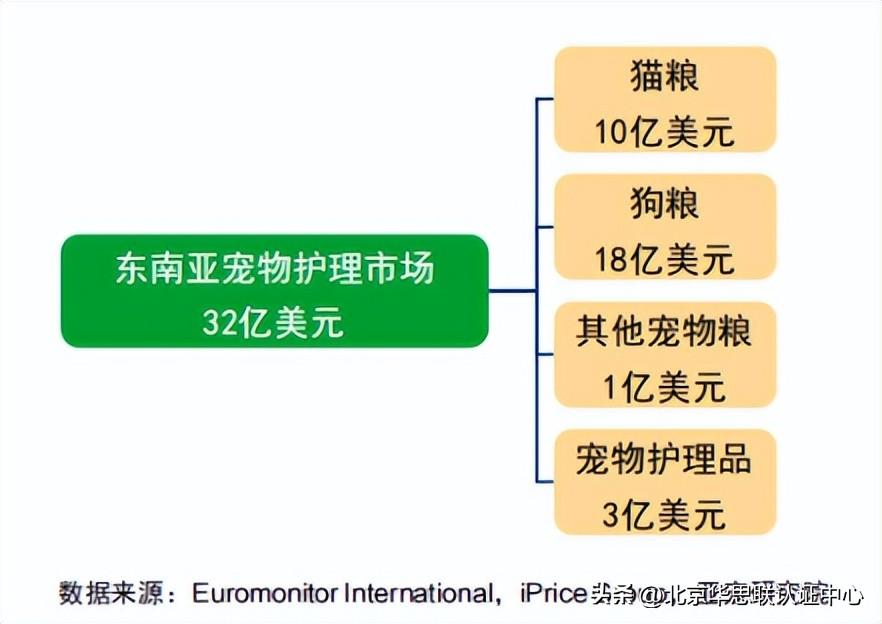

Retail scale of pet products may reach 3.2 billion US dollars

With the increasing ownership rate of pets in Southeast Asia, the consumption trend of pet products by pet owners is on the rise. According to the 2022 China Pet Industry Development Report, data shows that the retail market size of Southeast Asian pet products will reach 3.2 billion US dollars in 2022.

As mentioned earlier, due to differences in culture, religion, and pet preference among countries, pet owners in Southeast Asian markets also have different consumer demands for pets. According to relevant data statistics, Southeast Asia has the largest consumption expenditure on pet food categories, with the highest proportion of cat and dog food, and it is still increasing year by year.

Taking this type of product as an example:

Singaporean, Indonesian, and Thai consumers prefer high-end pet food products, with a particular emphasis on brand, ingredients, functionality, and hygiene/health needs; Malaysia and Vietnam, on the other hand, tend to prefer taste, green health, and nutritional supplements.

In addition to pet food, the demand for products in categories such as pet technology, home, transportation, cleaning, beauty care, and toys is also growing.

There is a commonality in Southeast Asian pet consumption, where products that pursue cost-effectiveness and offer discounts are particularly popular, while also paying attention to the functionality, practicality, and durability of the products.

05

Write at the end

Whether in relatively mature markets or rapidly growing emerging markets, the development of the pet industry is constantly heating up, and products are also showing richness and diversification.

In Southeast Asia, with the development of the economy and more young people joining the ranks of nurturing pets, the methods of nurturing pets have become more refined and humane. They will spend more time with pets and invest a lot of money to improve their health and lifestyle, which will also make the pet consumption dividend in this market increasingly significant.

At present, the pet market in Southeast Asia is gradually entering a fast lane of development. In addition to the major six countries mentioned earlier, there are also significant potential business opportunities for pet consumption in Myanmar, Brunei, Laos, and Cambodia.