Challenge, transcendence, coll

Interpretation of the 2023 China Pet Food Market Consumption Report: Further Diversification of Category Structure and Changes in the Dog and Cat Market Pattern

During the pet owner's pet raising process, pet food is the part with the highest consumption frequency and amount. On the industry side, the pet food industry is also the largest and most fiercely competitive segment of the pet industry. However, as the largest market segment in the pet industry, with the largest number of brands and the most attractive financing, the pet food industry also faces many challenges. To this end, the white paper team spent 4 months understanding the needs of the enterprise, designing questionnaires, launching, cleaning, and analyzing data, mining conclusions from the data, and officially launched the "2023 China Pet Food Consumption Report". In order to help pet owners have a clearer and more intuitive understanding of the industry's current situation, this report conducted research on the standardization level, market size, user habits, and development trends of the pet food market, and analyzed the market status and development trends of pet food.

The market structure is relatively stable, and the market share of pet nutrition products has further increased

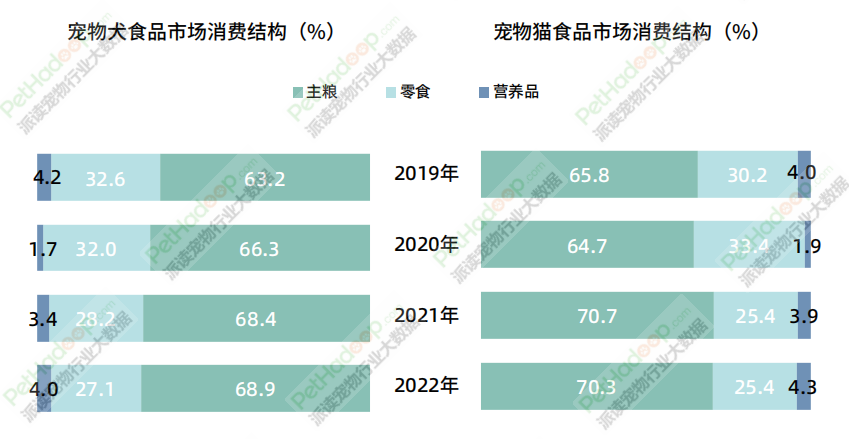

In the food market structure, the market share of staple foods is stable, while the market share of pet dog snacks has slightly declined, while the market share of nutritional products has slightly increased. The market share of dog staple food was 68.9%, an increase of only 0.5% compared to previous years; The snack market share was 27.1%, a decrease of 1.1% compared to previous years; The market share of nutritional products is 4%, an increase of 0.6% compared to previous years. The market share of cat staple food was 70.3%, a decrease of 0.4% compared to previous years; The snack market share is 25.4%, which is unchanged from previous years; The market share of nutritional products is 4.3%, an increase of 0.4% compared to previous years. The increase in market share of dog and cat nutrition products is in line with the current consumption trend driven by refined and high nutrition pet care.

市场结构相对稳定,宠物营养品市场份额进一步提升

市场结构相对稳定,宠物营养品市场份额进一步提升In the food market structure, the market share of staple foods is stable, while the market share of pet dog snacks has slightly declined, while the market share of nutritional products has slightly increased. The market share of dog staple food was 68.9%, an increase of only 0.5% compared to previous years; The snack market share was 27.1%, a decrease of 1.1% compared to previous years; The market share of nutritional products is 4%, an increase of 0.6% compared to previous years. The market share of cat staple food was 70.3%, a decrease of 0.4% compared to previous years; The snack market share is 25.4%, which is unchanged from previous years; The market share of nutritional products is 4.3%, an increase of 0.4% compared to previous years. The increase in market share of dog and cat nutrition products is in line with the current consumption trend driven by refined and high nutrition pet care.

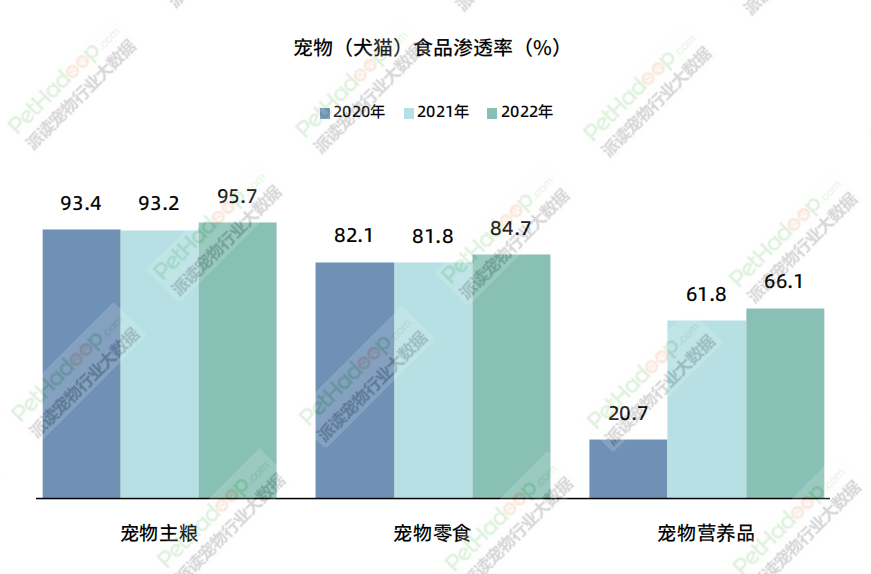

From the perspective of the penetration rate of pet food market, as the primary demand for pets, the penetration rate of staple food is higher than that of other categories and maintains a growth rate of 95.7%, an increase of 2.5% compared to previous years; The penetration rate of snacks is 84.7%, an increase of 2.9% compared to previous years. Among them, the penetration rate of dog snacks is 3.7% higher than that of cats; The penetration rate of nutritional products is 66.1%, an increase of 4.3% compared to previous years, with dogs and cats maintaining a consistent level.

The demand for pet care is further refined, and the preference for nutritious foods is gradually increasing

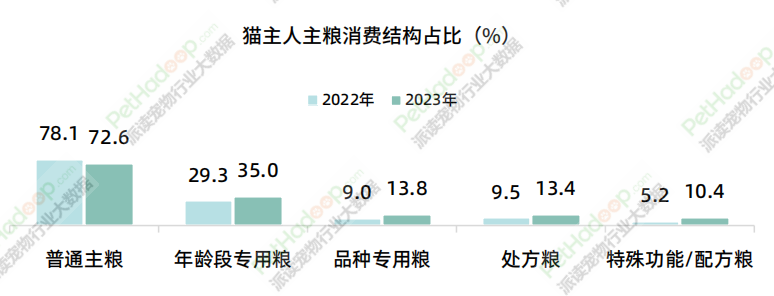

With the shift in pet owners' awareness of raising pets, the purchase rate of regular cat food has decreased by 5.5%, while refined foods such as age specific foods, prescription foods, and variety specific foods have increased. However, in the overall proportion of staple food consumption structure, ordinary staple food is still the mainstream consumer market, accounting for 72.6%; And the segmented nutritional grain market, with age specific grains accounting for 35%, variety specific grains accounting for 13.8%, prescription grains accounting for 13.4%, and special function/formula grains accounting for 10.4%.

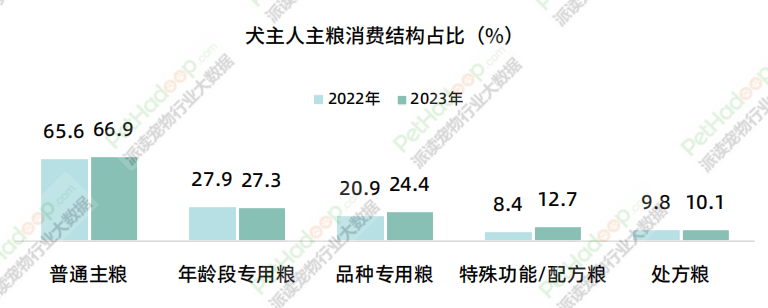

The general staple food market for dogs also saw a slight increase, from 65.6% to 66.9%, while the age group specialty food market slightly decreased from 27.9% in 2022 to 27.3%; And variety specific grains, special function/formula grains, and prescription grains have all increased, with the most significant increase being special function/formula grains, which increased by 4.3 percentage points compared to 2022, followed by variety specific grains, which increased by 3.5 percentage points compared to 2022.

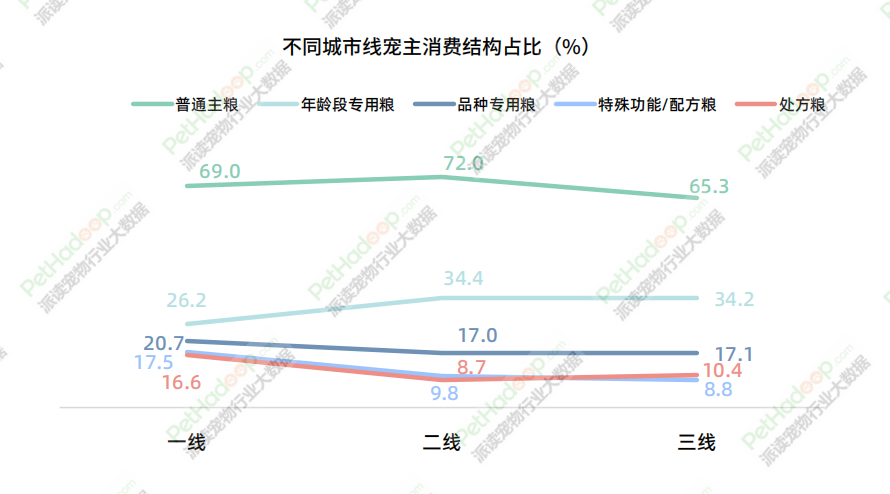

From the perspective of different city lines, ordinary staple food is the main category purchased by pet owners of various city lines, and there is no significant difference in the consumption structure among different cities. However, in contrast, pet owners in first tier cities tend to prefer specialty grains, special functions/formulas, and prescription grains, with a higher proportion of consumption structure compared to pet owners in second tier, third tier, and below cities. Second tier, third tier, and below urban pet owners prefer age specific grains, with 34.4% and 34.2% respectively.

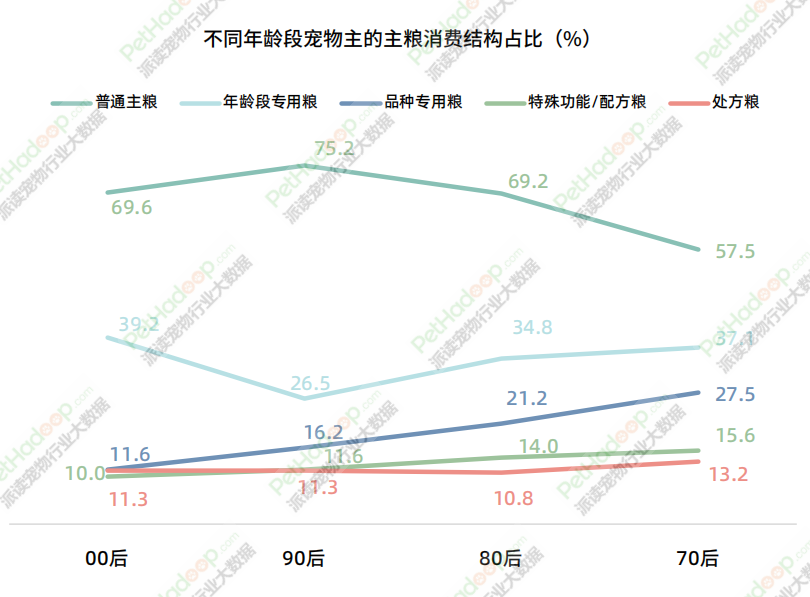

From the perspective of different age groups of pet owners, regular staple foods are the main staple food category for each age group, while pet owners born in the 2000s prefer to feed age specific foods, accounting for 39.2%; But as they grow older, the preference of pet owners for choosing specialized grains gradually increases.

Freeze dried and anti hyperexpanded grains have become the preferred category for cat pet owners

Expanded food and freeze-dried food are two major preferences for pet owners of dogs and cats when purchasing staple foods. In the main diet of dogs, puffed food is still the preferred choice for dog owners, but the proportion is only 1.9% of freeze-dried food; And the preferences of cat pet owners for staple foods have gradually refined, with a preference for freeze-dried grains exceeding that of puffed grains by 0.2 percentage points, becoming the main staple food category purchased by cat owners.

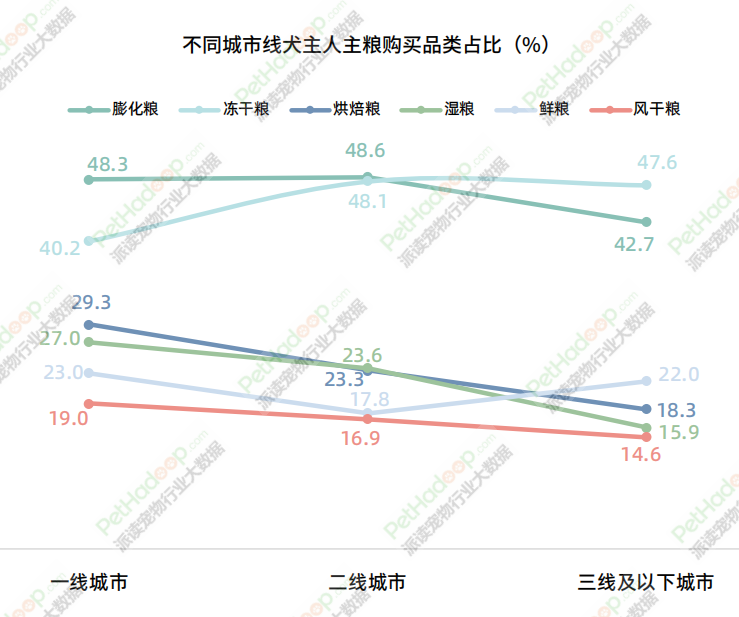

From different city lines, the preference of dog owners in first tier cities for baked goods, wet food, fresh food, and air dried food is higher than that of dog owners in second tier, third tier, and below cities, accounting for 29.3%, 27%, 23%, and 19%, respectively. The preference of dog owners in second tier, third tier, and below cities for freeze-dried food is higher than that in first tier cities, accounting for 48.1% and 47.6% respectively. In addition, dog owners in third tier and below cities have lower preferences for puffed food than those in first tier and second tier cities.

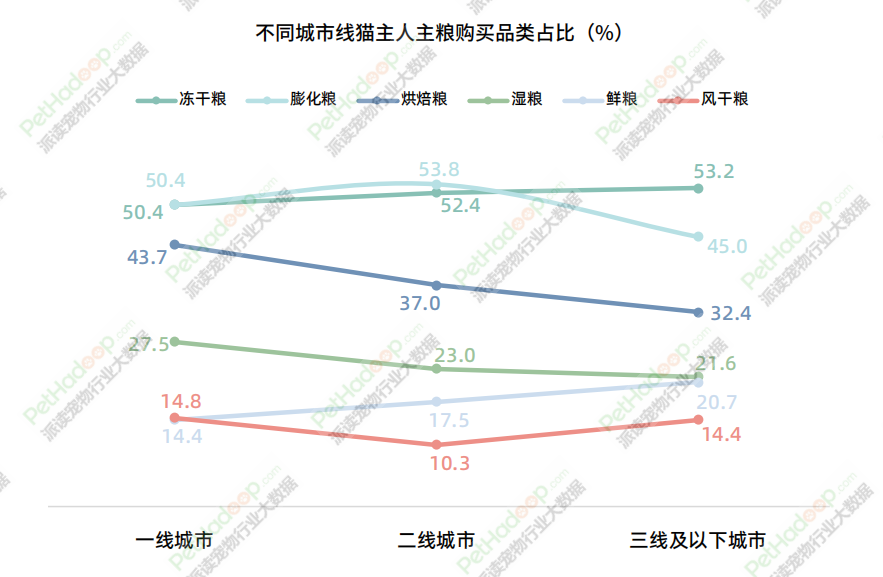

Meanwhile, cat owners in first tier cities have a higher preference for baked and wet grains than those in second tier, third tier, and below cities, accounting for 43.75% and 27.5% respectively; The preference for puffed food among cat owners in second tier cities is higher than that in first tier, third tier, and below cities, accounting for 53.8%; Third tier and below cat owners have a higher preference for fresh food than first tier and below city cat owners, accounting for 20.7%.

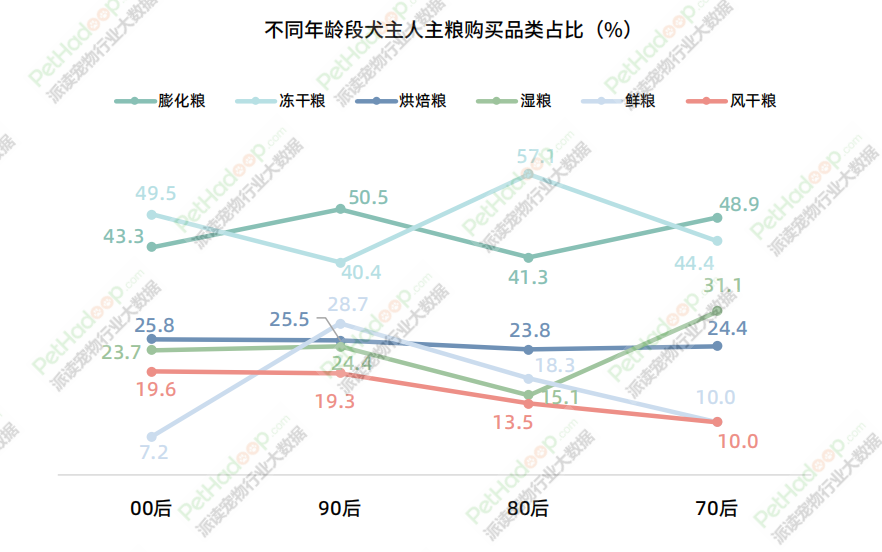

From the perspective of different age groups of pet owners, puffed food and freeze-dried food are the main food categories purchased by pet owners of dogs and cats in each age group. Among them, post-80s dog owners have a higher preference for freeze-dried food, accounting for 57.1%. Post 90s dog owners have a high preference for puffed food, at 50.5%. In addition, the preference for dried food among dog owners born in the 1990s and 2000s was higher than that of other age groups, accounting for 19.6% and 19.3% respectively. The preference for wet food among dog owners born in the 1970s was higher than that of other age groups, accounting for 31.1%.

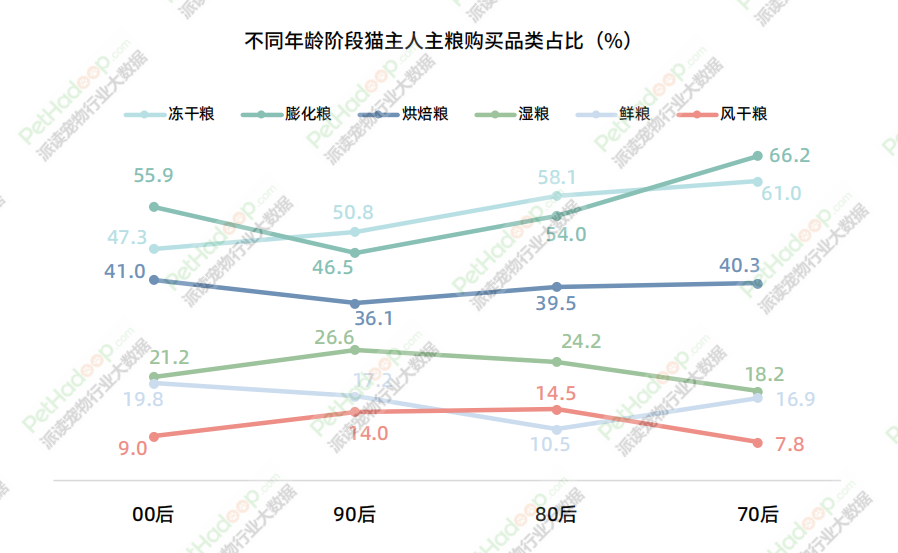

Among the preferences of cat owners, freeze-dried food is more favored by middle-aged and elderly pet owners, and as pet owners age, their preference for freeze-dried food gradually increases. Meanwhile, the proportion of pet owners born in the 1970s who purchase puffed food is higher than that of pet owners in other age groups, accounting for 66.2%. In addition, post-90s cat pet owners have a higher preference for wet food than other age groups, accounting for 26.6%. The preference for wind dried food among post 80s cat owners is higher than that of other age groups, accounting for 14.5%.

The feeding motivation of pet owners is relatively concentrated, with balanced nutrition and palatability being the main factors

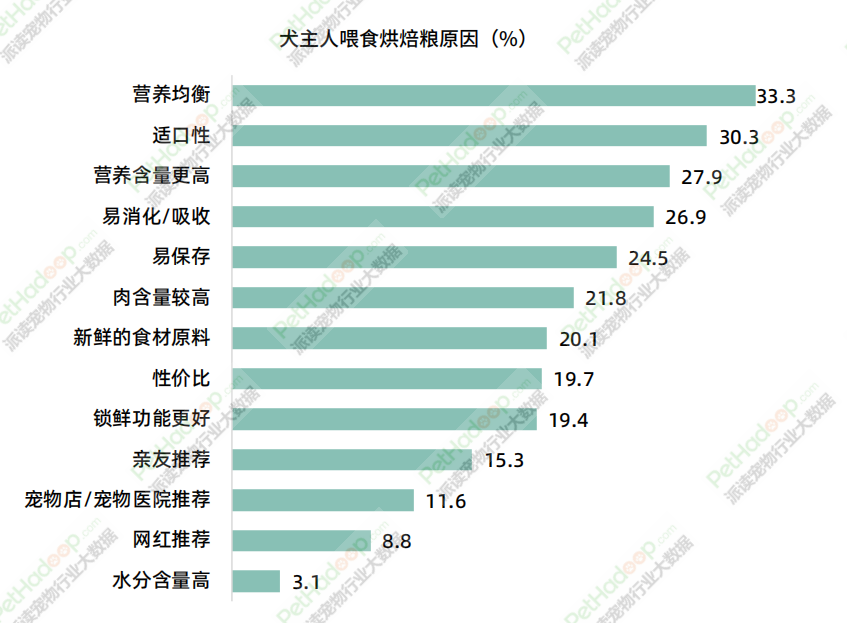

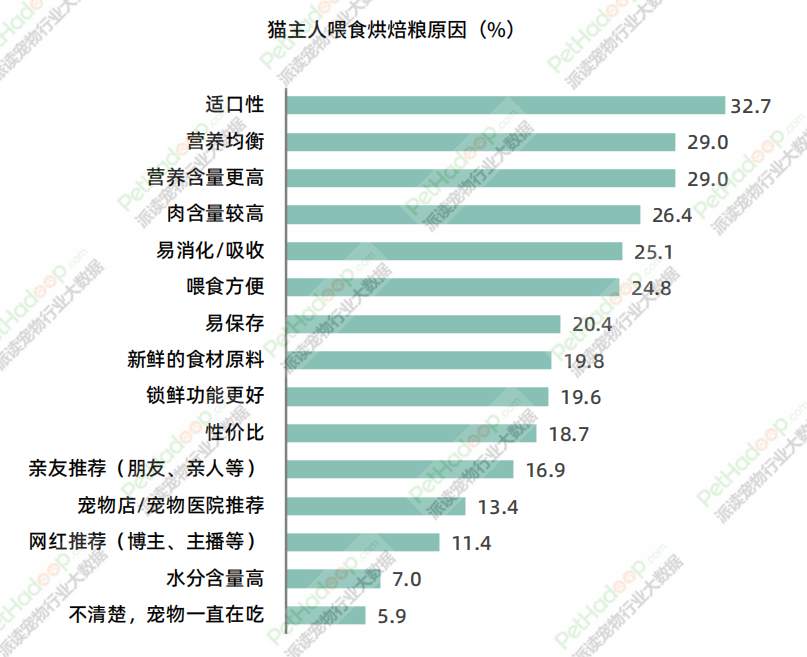

The motivation for pet owners to feed dogs and cats is relatively concentrated. When choosing a staple food, pet owners will first consider whether the product's nutrition is balanced and its palatability. Among the reasons for feeding roasted dog owners, nutritional balance accounts for 33.3%, palatability accounts for 30.3%, followed by higher nutritional content, easy digestion/absorption, all accounting for over 25%. Among the feeding reasons for cat owners, palatability accounts for 32.7%, nutritional balance accounts for 29%, and the same proportion is higher in nutritional content.

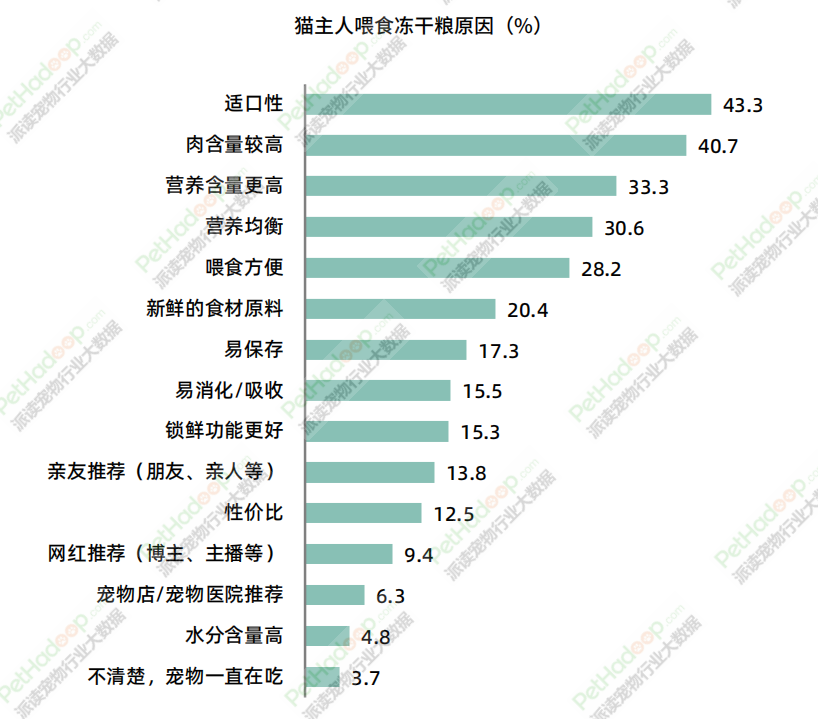

Among the reasons for feeding freeze-dried dog owners, palatability accounts for 36.2%, and nutritional balance accounts for 35.5%; Among the feeding reasons for cat owners, palatability accounted for 43.3%, followed by higher meat content, accounting for 40.7%.

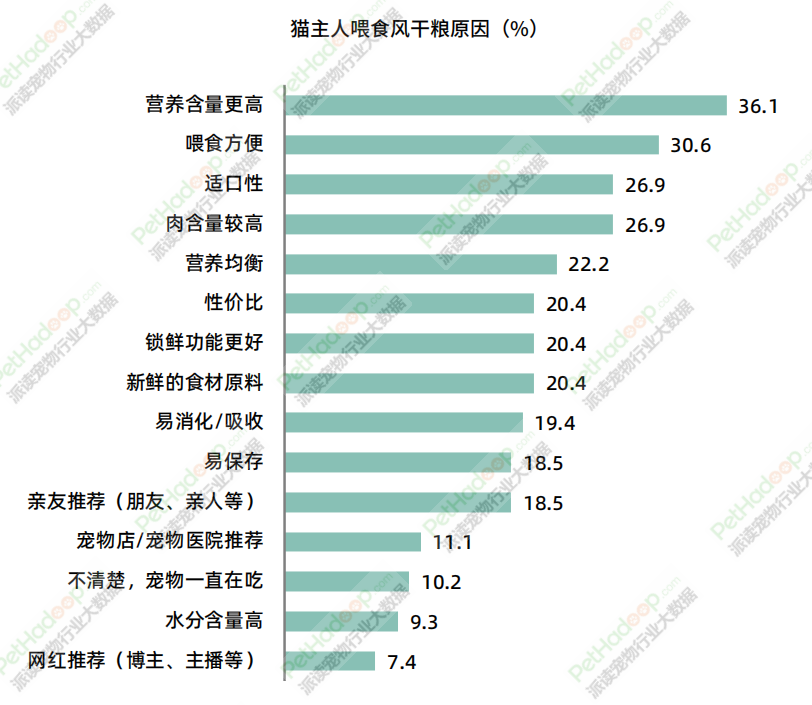

Among the reasons for feeding air dried dog owners, 34.9% of dog owners believe that air dried food is nutritionally balanced and choose to feed, 33% of dog owners believe that air dried food is convenient to feed, 32.1% of dog owners believe that air dried food has a higher meat content and choose to feed, and 30.2% of dog owners believe that air dried food has a higher nutritional content and choose to feed. The main reason for cat owners to feed is due to balanced nutrition, accounting for 34.9%, followed by convenient feeding and high meat content, accounting for 33% and 32.1% respectively.

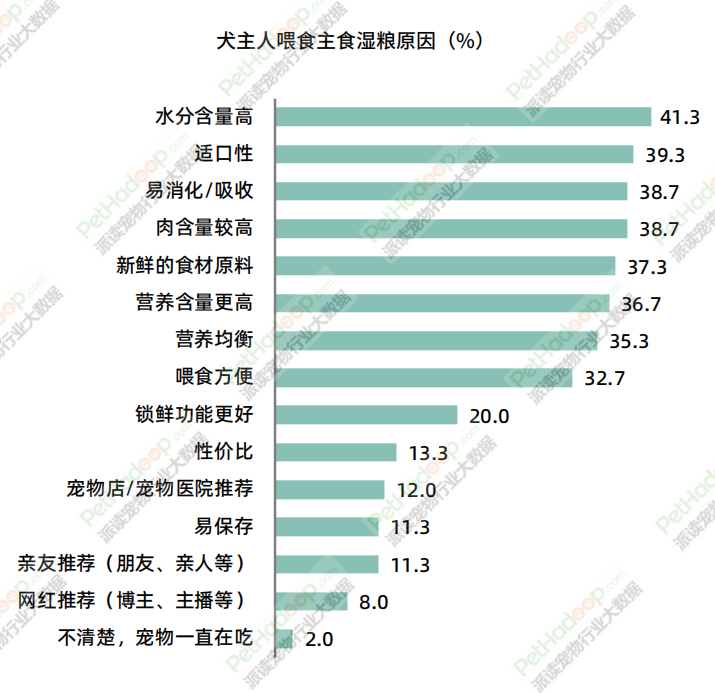

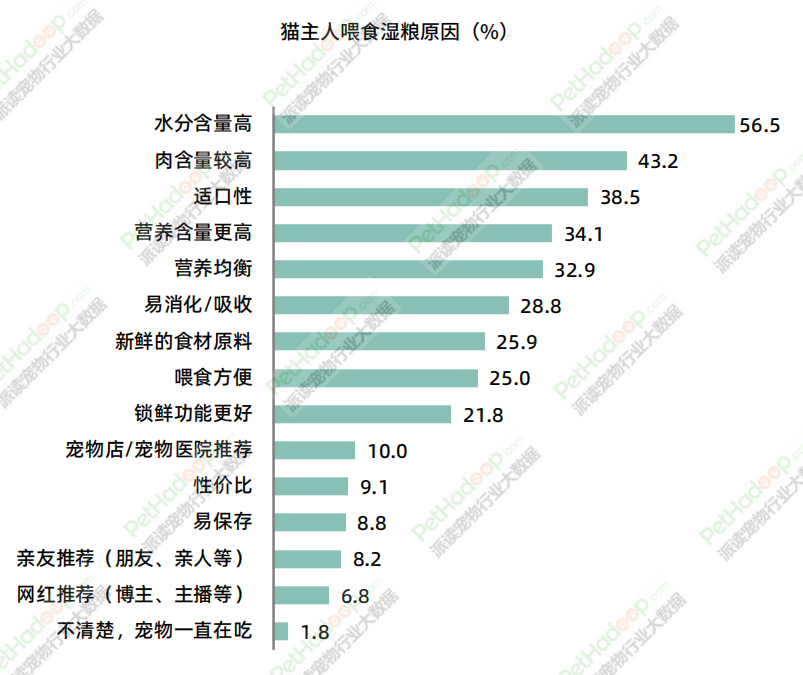

The feeding motivation of wet food is different from the previous types of staple foods. Dog pet owners are most concerned about whether the water content is high, accounting for 41.3%, followed by palatability, easy digestion/absorption, and high meat content, all accounting for about 39%. The feeding reasons for cat pet owners are also concentrated in high moisture content, accounting for 56.5%, followed by high meat content and palatability, accounting for 43.2% and 38.5% respectively.

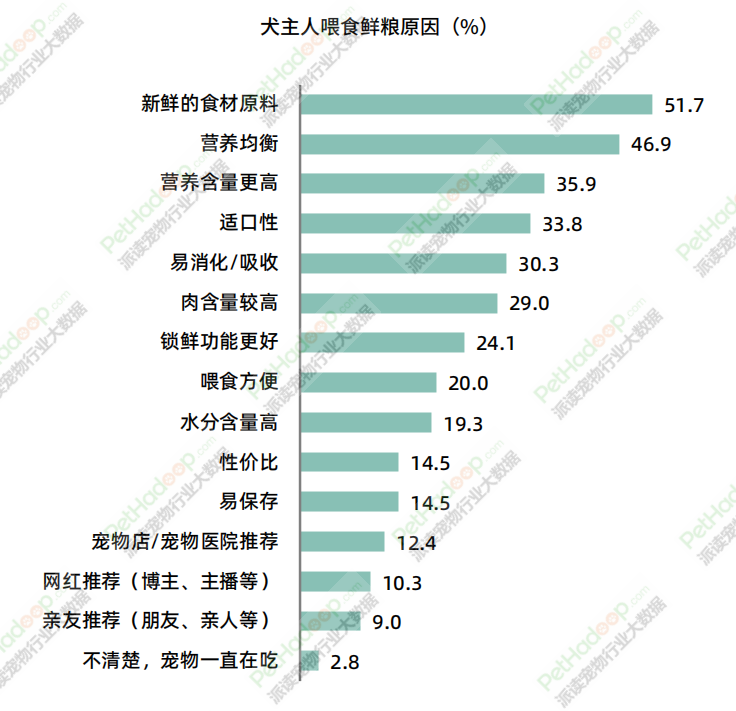

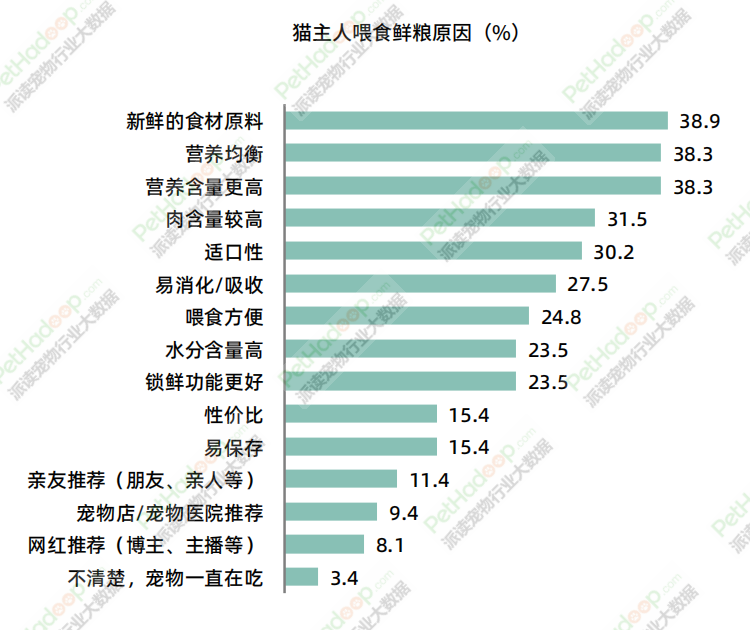

In the fresh food section, the main reason why dog owners feed fresh food is whether the ingredients are fresh, accounting for 51.7%, followed by balanced nutrition and higher nutrient content, accounting for 46.9% and 35.9% respectively. The reason why cat owners feed fresh food is the same as that of dog owners. The top three are fresh ingredients, with a higher nutritional balance and content, but a relatively low proportion of 38.9%, 38.3%, and 38.3%, respectively.

Lack of understanding of the product is the biggest pain point for pet owners

Among the pain points of pet main food feeding, uncertainty about whether the main food is suitable for pets, whether the main food nutrition is sufficient, and there are many products. Not knowing how to choose a suitable main food is the top three pain points of pet main food, accounting for 17.9%, 13.9%, and 12.3%, respectively. The second is the lack of trustworthy domestic food brands, accounting for 11.7%. Other pain points did not exceed 10%.

From the perspective of different city lines, the feeding pain points of pet owners in first and second tier cities are mainly uncertain whether they are suitable for pets, while the feeding pain points of pet owners in third tier and below cities are mainly uncertain whether their nutrition is sufficient. In addition, first tier cities are more concerned about the palatability of their products.

From the perspective of different age groups, uncertainty about whether pets are suitable and whether nutrition is sufficient are the main feeding pain points for pet owners in each age group. Among them, the proportion of pet owners born in the 2000s is higher than that of pet owners in other age groups, which is the main consumption pain point for their age group. For the post-90s generation, the lack of trustworthy domestic brands is the main consumer pain point for their age group. For the post-80s generation, the instability of imported grain supply is their main consumption pain point.